Mortgage Lending Software

Turn Dreams into Deeds with Intelligent Automation.

Give every borrower a faster path to homeownership with Zoot’s flexible mortgage loan software powered by intelligent automation.

Speed Up Mortgage Approvals

Deliver faster lending decisions with our automated workflows, real-time data, and built-in exception handling

Stay Compliant Without Delay

Meet regulatory demands with full visibility, audit trails, and dynamic rule updates.

Boost Retention with Personalisation

Keep more customers by tailoring retention offers to each borrower, whether they are renewing, refinancing, or switching

Digital Mortgage Lending Features

Whether you’re onboarding first-time buyers or serving complex applications, you can build fast, flexible, and compliant mortgage journeys—tailored from application to approval to retention.

Tailor Offers for Higher Retention

Mortgage customers want options…and they’ll look elsewhere if you don’t deliver. We help your product, servicing, and retention teams keep them with:

Real-time borrower evaluation, including history and income.

Personalised retention offers that make staying the easy choice.

Timely, relevant, and profitable decisions powered by our advanced decision engine

Boost engagement, improve retention, and cut costs—whether reacting to expiring rates or reducing churn.

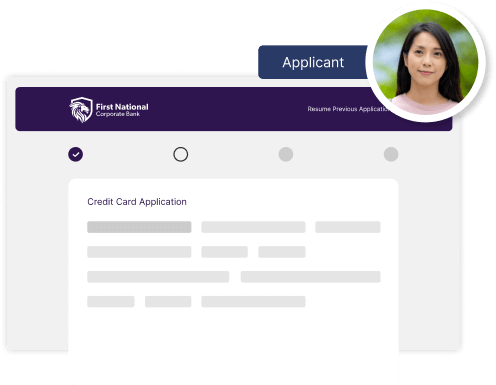

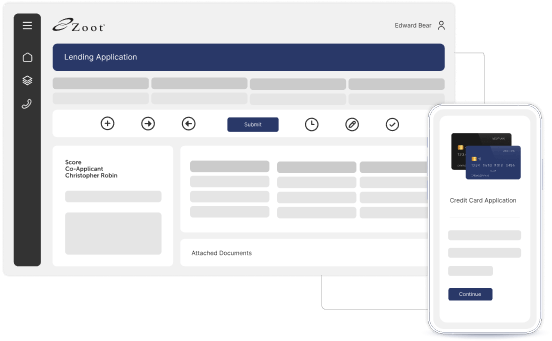

Simplify the Borrower Experience and Your Workflows

Give your borrowers the convenience they want. Your customer experience and operations teams can deliver, from first touch to final offer, with:

Intuitive, signature-free interfaces that simplify every step.

Automated workflows that speed up approvals and reduce drop-offs.

Intuitive payment integration for fast, hassle-free completion.

Branded application flows tailored for brokers and borrowers.

Stay in control with in-platform product switches, real-time tracking, and fewer support queries through reliable processes.

Serve Complex Borrowers with Speed and Precision

Self-employed. Buy-to-let. Multi-income. Our platform simplifies underwriting for complex borrowers.

Advanced case management to handle nuanced applications.

Smart automation to streamline routine tasks.ureau pulls)

Centralised workspace for faster manual reviews and exception handling.

Simplified documentation to reduce back-and-forth.

300+ data sources and automated decisions — turning complexity into simplicity.

Stay Compliant Without Slowing Down

Managing risk and compliance doesn’t have to slow you down. Our platform unifies systems, data, and rules so your teams can move faster.

Automated document and contract generation with e-signatures to save time.

Traceable decision trails for full transparency.

Quick updates to lending rules in minutes.

New scorecards onboarded in hours.

Adapt confidently as the market shifts. Turn compliance into a strength, not a burden.

Zoot’s Digital Mortgage Lending Solution

Deploy Full Mortgage Workflows from Inquiry to Underwriting.

Launch mortgage products faster with our mortgage lending solution’s predefined borrower journeys, document collection processes, and credit evaluation logic. Everything is preconfigured, fully customisable, and built to move with your policies, lender types, and product offerings.

Prebuilt borrower flows

Support first-time buyers, remortgages, or buy-to-let with application and underwriting journeys that are ready to use and easy to adapt

Proven risk and eligibility checks

Roll out faster with income validation, affordability checks, and credit rules already configured, all customisable to your lending policies

Integrated data connections

Plug into credit bureaus, open banking, and third-party verification providers through pre-integrated connectors that are tested and ready to go

Ready to Rethink Mortgage Lending?

Let’s set your team up to deliver smooth lending experiences with a tailored platform for home loans