Zoot’s Consumer Lending Platform

Originate Consumer Loans with Speed, Control, and Scale

Build digital lending journeys for retail finance, BNPL, or personal loans with a platform that’s modular, configurable, and ready to go in under 90 days.

Prebuilt Lending Flows

Use industry-tested templates to build application-to-decision workflows.

Real-Time Decisioning

Automate credit decisions with built-in scoring logic and policy execution, so every application is processed instantly and accurately.

Modular Lending Engine

Configure and reorder rules and workflows for affordability, fraud, ID verification, and different loan types, supporting BNPL, term loans, and personal credit.

Configurable Lending Journeys for Retail, BNPL & Consumer Finance

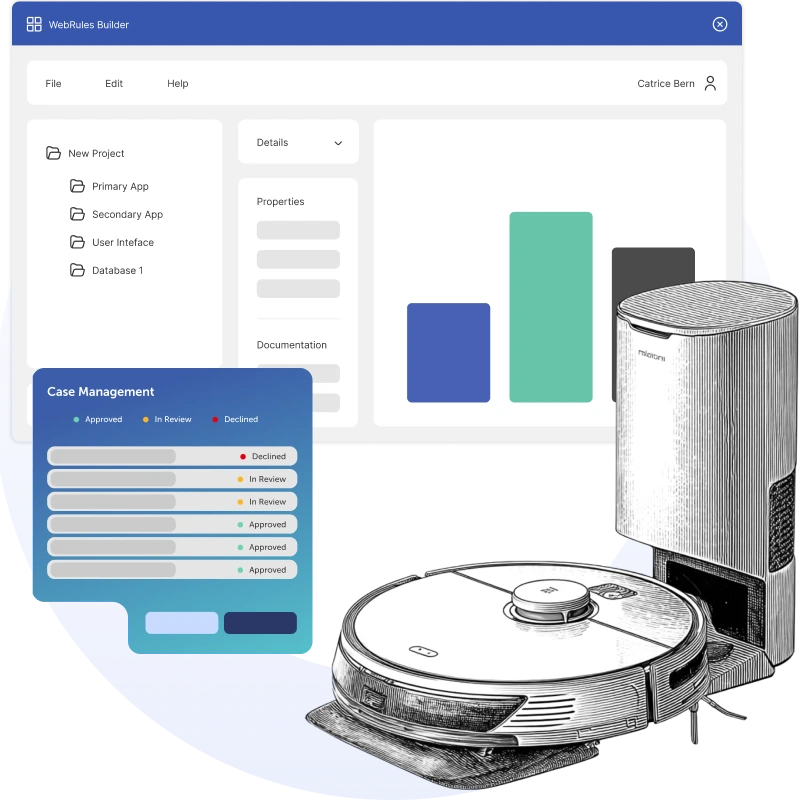

Our consumer lending solution is built for speed and adaptability. Whether you’re launching BNPL, personal loans, or instalment financing, our modular platform digitises origination end to end, from application to final decision. Designed for scale and long-term performance, it comes with best-practice rules, ready-made data connectors, and tools for rapid adjustment. All are maintained within a clear architecture and governed through intuitive admin panels, structured datastores, and WebRules Builder.

Multi-Channel Application Intake

Accept applications any way you like: through a web portal, broker platform, or API. No matter the source, everything is normalised and routed through the same smart logic.

Internal Data Policy Evaluation

Before external checks, the system executes a series of configurable internal policy rules across both application and applicant data to assess completeness, velocity, and customer status.

External Data Policy and Risk Evaluation

The platform connects to credit bureaus, fraud prevention providers, and KYC/AML databases to retrieve external data. Credit scores, risk grades, and PD bands are then calculated for automated decisioning and pricing logic.

Affordability & Open Banking Checks

Affordability is validated using income and outgoings data, with the option to add open banking. Where customers consent, transaction data gives you richer insights for fairer, more precise decisions.

Fraud, AML & Bank Account Validation

Fraud checks, AML screening, identity verification, and bank account ownership validation are built in using configurable policy rules and external data providers.

Decisioning & Underwriting

Final automated decisions are referred to underwriters based on predefined criteria. Underwriters can view all relevant flags, modify data, and execute tasks within a unified interface.

Offer Completion, Documentation & Response

Personalised offers, APR calculations, and required documents are generated instantly. E-signature and real-time responses are fully supported, including process re-entry if needed.

Configurable Lending Workflows and Tools

Speed Up Time to Market

Go live in under 90 days with predefined workflows, built-in integrations, and best-practice lending logic.

Support Multiple Lending Models

Run BNPL, term loans, and personal credit lines side by side. Each model comes with its own configurable workflow, pricing, and approval criteria.

Enable Rapid Change

Update scoring, rules, and workflows directly through admin tools and datastore configurations, without long dev cycles.

Simplify Development and Support

Reduce onboarding and QA effort with reusable logic, well-documented architecture, and clear design principles.

Lending Models Supported

Buy Now, Pay Later (BNPL)

Term Loans

Revolving Credit

Instalment Loans

Deferred Payment Options

Unsecured Personal Loans

Embedded Retail Finance

White-Label Lending

Bring Consumer Lending to Market. Fast and Flexible.

Let’s explore how Zoot makes launching BNPL, personal loans, or term credit simple, scalable, and under your control.