BNPL Software

Convert More Shoppers, Drive More Sales.

Turn more shoppers into loyal buyers with Zoot’s intuitive Buy Now, Pay Later application experiences, instant approvals, and automatic onboarding.

Boost Sales and Revenue

Grow your business with our flexible, branded BNPL options that convert browsers into buyers and increase your average order value

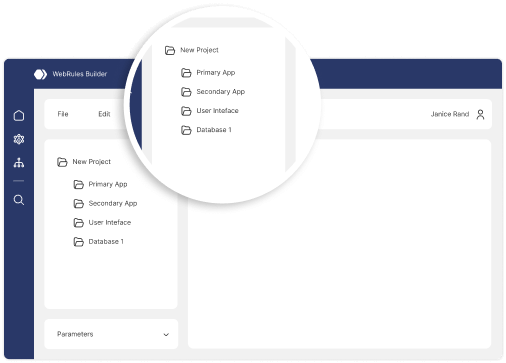

Own Your BNPL Experience

Stay in control of customer journeys, data, and compliance with our built-in audit trails and dynamic rule management.

Make Faster Lending Decisions

Say yes to the right customers instantly by using our real-time data, automated underwriting, and configurable risk models.

Buy Now, Pay Later Software Features

From instant credit decisions to configurable repayment terms and built-in compliance, we give you everything you need to design, launch, and scale BNPL on your terms.

Build BNPL Your Way

Our software gives your product, customer experience, and merchant teams full control over how BNPL is offered and experience:

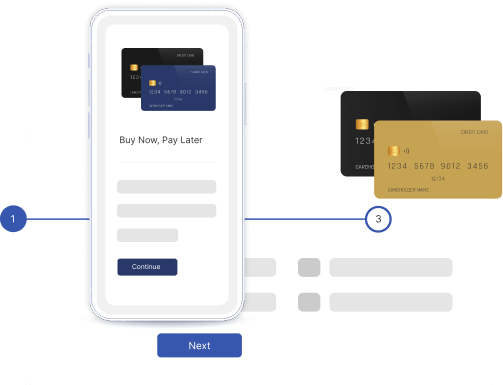

Launch BNPL from your checkout or mobile app.

Set your own terms, journeys, and branding.

Tailor instalment plans by region, product, or customer profile.

Deliver a branded onboarding flow that reduces drop-offs

Do it all from one flexible, configurable platform, built around your business.

Make Smarter Risk Decisions, Instantly

Give your credit and risk teams the tools to make confident lending calls in milliseconds with a platform that lets you:

Apply your credit policies automatically

Use real-time data to assess eligibility

Configure risk models to suit your business

Approve the right customers, faster

Need a human touch? Easily route edge cases to underwriters with built-in case management and hybrid decision flows.

Effortlessly Scale to Meet Growing Demand

Whether you’re launching a pilot or serving millions, our platform scales with your BNPL ambitions. Equip your IT and product teams to:

Handle high application volumes easily

Adapt offers on the fly

Add new data sources without code changes or vendor delays

Stay Compliant Amid Changing Regulations

Our platform helps your compliance and legal teams stay ahead of regulatory change with:

Built-in audit trails for full transparency

Dynamic rule updates to match changing regulations

Configurable user journeys for complete control

Plus, integrate easily with third-party services like open banking, identity providers, and fraud databases to meet KYC and AML requirements.

Zoot’s Preconfigured Industry Solution | Consumer Lending

Launch BNPL at checkout without the heavy lift. Our consumer lending solution comes with predefined application flows, risk rules, and data connections so you can go live and stay in control.

Prebuilt Checkout Journeys

Deploy seamless BNPL flows across e-commerce platforms and deliver instant customer decisions with minimal effort across e-commerce platforms.

Proven Risk Logic

Manage fraud, affordability, and repayment risks with out-of-the-box rules that adapt easily to market changes.

Integrated Data Connections

Connect instantly to credit bureaus, bank data, and identity services through ready-made integrations.

Built for Your Industry

Retail & E-Commerce

See how seamless, branded digital lending can boost conversions and customer loyalty in retail and ecommerce.

Payments

See how PSPs and fintechs launch fast, flexible BNPL with Zoot’s scalable platform.

Ready to Build BNPL on Your Terms?

Let’s help you design a branded, compliant, and high-performing BNPL experience that scales with your business