Consumer Lending Software

Turn Borrower Journeys Into Instant Loan Decisions.

Give your borrowers a smooth, digital journey and let your team approve the right loans faster with Zoot’s fully configurable consumer lending solution.

Boost Digital Conversions

Make it easy for customers to start their journey with fast, branded onboarding that works on both web and mobile.

Accelerate Loan Decisions

Say yes to the right loans faster, with built-in data orchestration and automated decision-making tools in one place.

Automate Risk Checks

Let automated checks take care of KYC, AML, and fraud screening. No manual steps or third-party juggling

Consumer Lending Features

From easy digital onboarding to fast, confident approvals, our consumer lending solution helps your teams move borrowers through every step by automating workflows and managing risk, without the usual hassle.

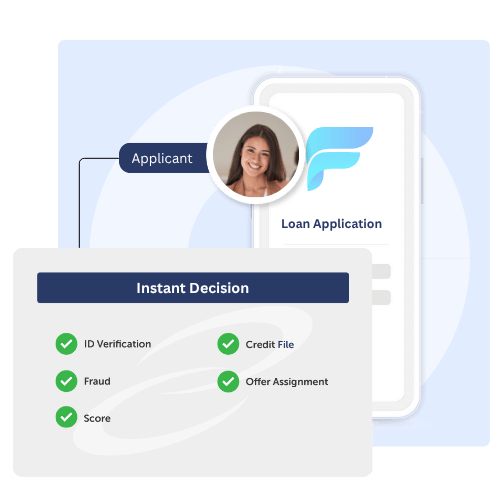

Speed up Confident Lending Approvals

In consumer lending, speed isn’t just a convenience—it’s a competitive advantage. From personal loans to retail finance, lenders need to deliver instant decisions without compromising risk oversight or compliance.

Reduce drop-off rates with seamless, responsive credit journeys

Automate risk, fraud, and affordability checks in real time

Deliver sub-second decisions for personal loans and retail financing

Access 350+ data sources instantly through pre-integrated connectors

With faster, smarter decisions, you convert more applicants, reduce overhead, and meet rising customer expectations.

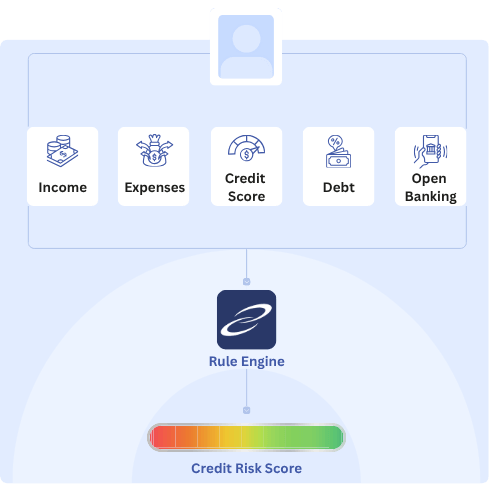

Assess Creditworthiness in Real Time

In personal lending, long-term success depends on making responsible credit decisions from the start. Zoot helps you assess creditworthiness and affordability in real time—so you can lend with confidence and care.

Combine traditional credit scores with real-time income and expense data

Automate affordability checks using bureau, open banking, or declared data

Apply tailored rules for product types, income levels, or risk bands

Flag borderline cases for manual review through integrated case handling

Better credit decisions mean fewer defaults, more sustainable growth, and fairer treatment for every applicant.

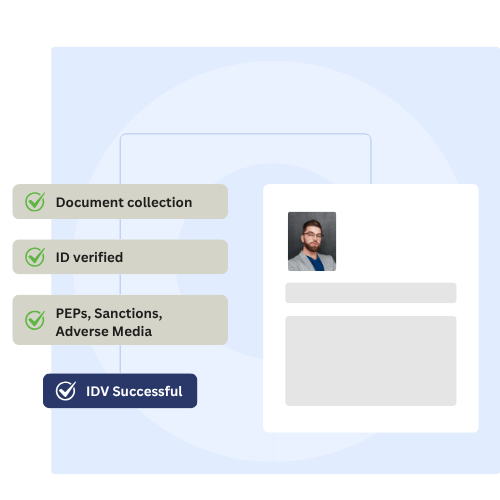

Stop Fraud Before It Starts

Fast applications shouldn’t mean blind trust. Zoot helps you prevent fraud and identity misuse by embedding intelligent controls directly into the credit journey.

Run real-time identity verification at onboarding

Detect synthetic identities, account takeovers, and data anomalies

Integrate watchlist screening, behavioural data, and blacklist logic

Route suspicious applications to structured manual review instantly

Protecting your portfolio starts with knowing who you’re dealing with—before the money goes out the door.

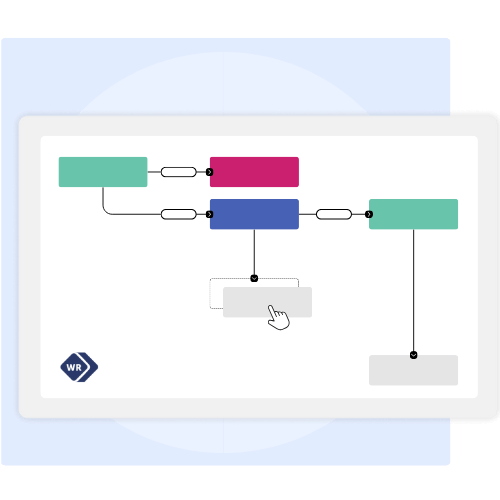

Move Fast and Change Without Friction

Whether you’re reacting to regulatory updates, adjusting risk thresholds, or launching new loan products—speed matters. Zoot gives you full control over decisions, journeys, and workflows, so you can adapt instantly without waiting on IT or vendors.

Update credit policies, onboarding screens, and workflows in real time

Empower business users to test, launch, and govern logic independently

Localise decisions per product, country, or brand—all from a single platform

Ensure transparency with version control and audit trails.

With Zoot, agility isn’t limited to developers—it’s built into the platform, ready for your business teams to drive change at scale.

Zoot’s Preconfigured Industry Solution | Consumer Lending

Launch new lending products in weeks, not months. Our consumer lending solution comes with ready-to-use digital flows, proven risk strategies, and built-in data connections, all fully customisable so you can move fast without losing control.

Prebuilt Digital Workflows

Guide your customers from application to approval with flows designed for unsecured lending, instantly deployable and easy to tailor.

Preconfigured Rules & Workflows

Apply tried-and-tested credit and affordability checks with configurable rules and scorecards, so you don’t have to build from scratch

Composable Architecture

Access leading credit bureaus, fraud detection services, and identity providers through ready-made integrations that save time and reduce complexity.

Why choose Zoot?

99% Uptime

350+ Data Providers

Consumer Lending Built for Your Industry

Banking

Discover how automation and real-time data power banks to approve loans faster and stay fully compliant.

Retail & E-Commerce

See how seamless, branded digital lending can boost conversions and customer loyalty in retail and ecommerce.

Frequently asked questions

How can I automate the consumer loan approval process?

We enable low-risk applications to be auto-approved in seconds, while routing complex cases to underwriting, with full audit trails.

How do I streamline KYC and fraud checks?

Use our Data Gateway to orchestrate checks across multiple providers in a single workflow—no need for custom integrations.

Can I customise the onboarding flow for different customer types?

Yes. We offer flexible, drag-and-drop configuration to create distinct journeys for salaried individuals, freelancers, or SMEs.

How quickly can I launch a new lending product?

Go from idea to launch in a matter of weeks with reusable templates, low-code tools, and pre-integrated data sources.

Say Yes Sooner, Without Second-Guessing

Let’s help you build frictionless lending from day one.