SME Lending Software

Turn Complex Applications into Fast Decisions.

Speed through complex applications with Zoot’s SME lending solution with smart automation, built-in risk checks, and tools that keep underwriters focused.

Approve Complex Loans Faster

Speed through intricate SME loan requests with our structured and unstructured data inputs, multi-entity underwriting, and flexible workflows.

Stay Agile, Stay Compliant

Launch new products, update rules, and meet regulatory demands without IT bottlenecks or audit worries.

Lend Smarter, Securely

Make responsible lending calls by using our integrated fraud checks, credit data, and business insights.

SME Lending Feature

Small and medium enterprises lending moves fast, and so should you. Our platform streamlines onboarding, decision-making, and contract generation so your teams can work smarter without missing a compliance beat.

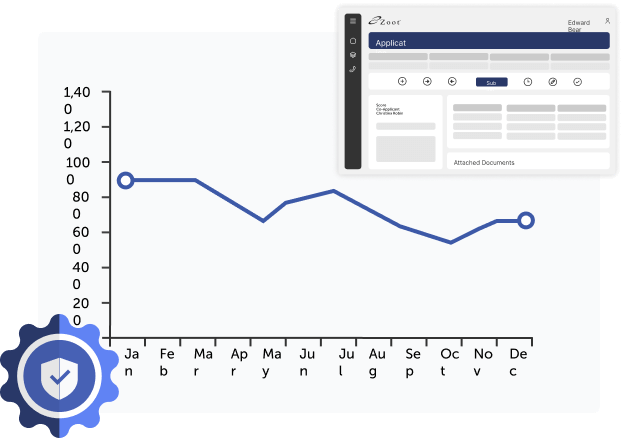

Streamline SME Assessments, Reduce Bottlenecks

From balance sheet analysis to fraud risk scoring, we help bring structure to unstructured processes so your underwriting and product teams can:

Connect all data for a complete borrower view.

Assess SME borrowers faster and more confidently.

Streamline manual reviews with intelligent automation and decisioning tools.

Personalise loan offers with real-time risk insights.

Fewer bottlenecks. Smarter decisions. Stronger outcomes.

Access Trusted Data Instantly

Zoot gives you instant access to data from credit bureaus, registries, and fraud detection providers so your credit and risk teams get:

Access to relevant data exactly when they need it.

Real-time insights for accurate risk assessment.

SME lending decisions backed by trusted information.

From startups to scale-ups, your team’s every decision can be smarter and more confident.

Adapt Quickly to Business Needs

Business needs change, and our SME lending platform lets you change with them by helping your product managers:

Launch new products without calling IT.

Adjust eligibility criteria on the fly.

Experiment with new data sources easily.

Our low-code interface puts control directly in your team’s hands.

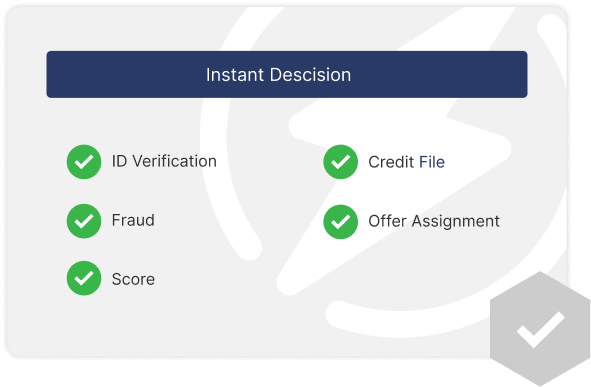

Protect Your Business with Automated Compliance

Our decision workflows automate key compliance checks—including AML, GDPR, and KYC/KYB—and ensure every change is tracked and auditable. This means your compliance, legal, and risk teams get

Automated compliance checks for faster, safer decisions.

Full audit trails and secure document storage for peace of mind.

Zoot’s SME Lending Solution Prebuilt Journeys for Smarter Business Lending.

Give SMEs faster access to finance with preconfigured application flows, proven risk checks, and ready-to-use data connections. Built on our consumer lending framework, our SME lending solution is tailored for small and medium business needs; quick to deploy, easy to customise.

Prebuilt digital workflows

Included out of the box for direct, broker or agent-led applications, our digital workflows support structured decision paths for business borrowers.

Proven risk rules

Predefined risk rules, such as KYB, credit and financial data checks, and configurable policy controls adapt to your credit appetite.

Integrated data connections

Our solution instantly connects you to credit bureaus, company registries, and compliance data providers without the need for development.

Why choose Zoot?

24x Faster Underwriting

30x Faster Approvals

6x Processing Capacity Improvement

Frequently asked questions

What benefits do financial institutions get from Zoot’s SME lending solution?

Speed, accuracy, and configurability. We help lenders streamline SME loan approvals, improve risk accuracy, and deliver tailored experiences, without adding complexity.

How does Zoot ensure compliance in SME lending?

Our platform automates key regulatory checks, such as AML, GDPR and KYC/KYB, stores documents securely, and provides audit-ready tracking for every decision.

Can business users create or change lending rules?

Yes. With our low-code interface, business users can launch, test, and adjust rules or flows—no IT needed.

How is fraud and identity handled for SME loans?

We integrate identity verification, fraud signals, blacklists, and registry checks into the onboarding and decisioning process for secure lending.

Fuel SME Growth, Without the Growing Pains

Let’s build a smarter, faster business lending engine today.