Asset Finance Software

Less Complexity, More Capital on the Move

Cut the admin and move your capital faster with Zoot’s asset finance software made to speed up decisions while keeping control, compliance, and clarity.

Speed Up Loan Approvals

Get your capital moving quickly and efficiently by simplifying underwriting and cutting down manual tasks.

Grow Without the Complexity

Adapt and grow more easily by using our flexible, modular platform built to handle all kinds of assets and keep up with changing market needs.

Stay Ahead of Risk

Detect vulnerabilities early and accurately with integrated compliance checks and clear audit trails.

Asset Finance Software Features

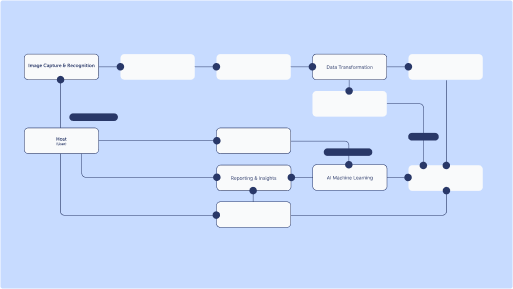

From intake to final approval, our platform takes the complexity out of asset financing. We take care of the admin and automation, so you can stay focused, flexible, and in control.

Speed Up Deployment with Pre-Configuration

Our enterprise-ready software for equipment finance is fast to deploy and easy to integrate, without giving up flexibility. Your product and IT teams get:

Pre-configured workflows and compliance modules

Proven integration patterns for faster setup

Connections to brokers, CRMs, and sourcing platforms

Support for credit checks, ID verification, and contracts

Tools that work for both business and technical teams

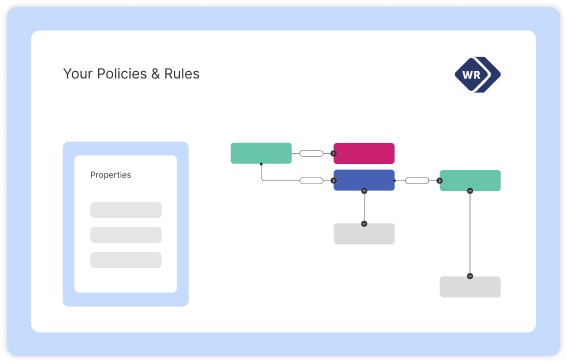

Customise Workflows for Any Product or Risk

Our platform supports the full range of secured asset and equipment financing products. With configurable workflows and approval tools, your product and risk teams can easily adapt to:

Risk profiles

Asset types

Product complexity

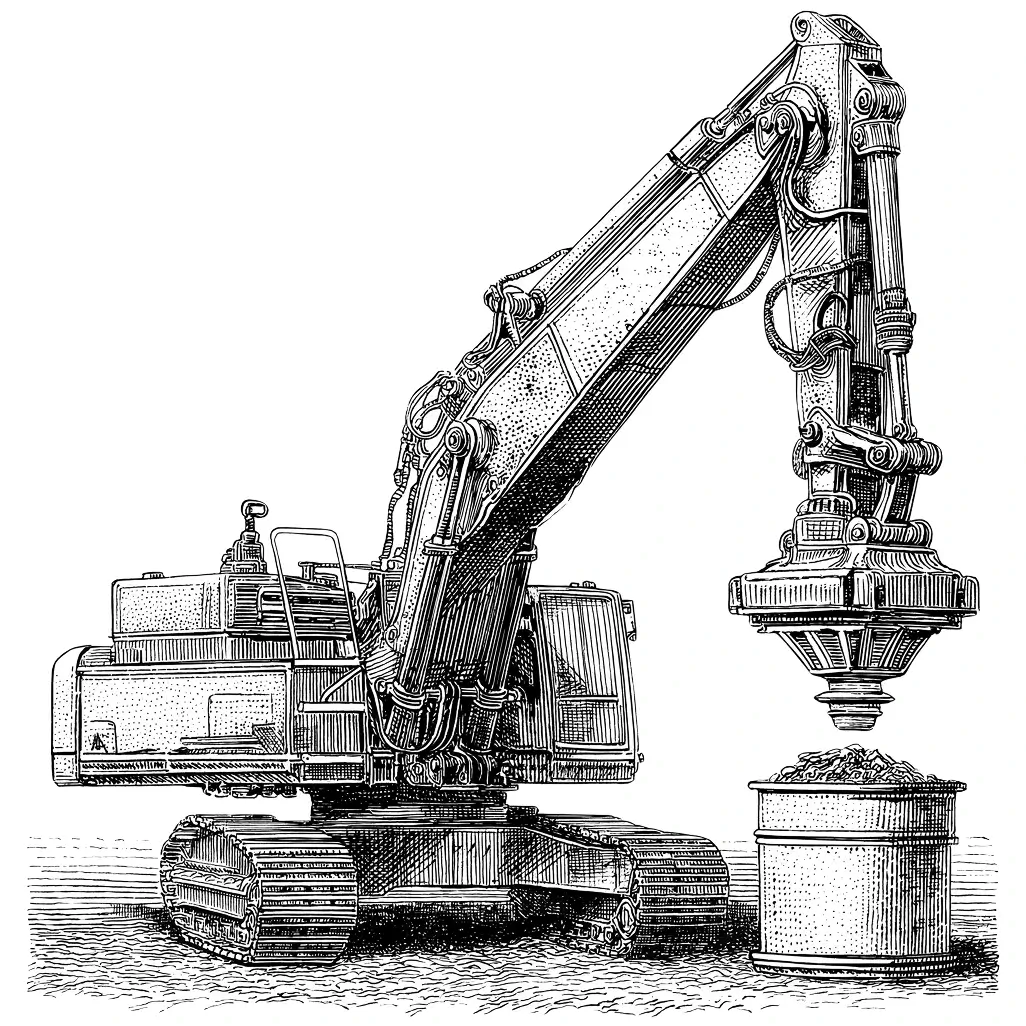

Built with input from leading financial service providers to reflect real-world processes, our software can handle construction machinery, industrial equipment and agricultural and specialty assets.

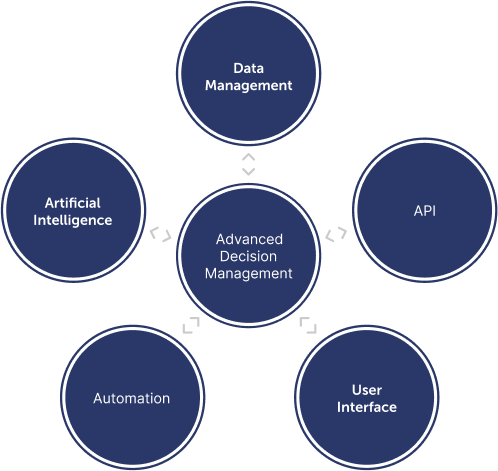

Break Free from Legacy, Lead with Innovation

Leave legacy complexity behind and innovate with confidence. Our platform is built to evolve with your strategy and scale with your growth. What sets it apart is our:

SOC 2 and PCI DSS certified for top-tier security

High-performance, modular architecture

Intelligent automation for faster delivery

Transparent decisioning with full audit trail for total accountability

We help you move faster, reduce technical debt, and future-proof your business.

We help you move faster, reduce technical debt, and future-proof your business.

Our asset finance solution is built for leasing or financing machinery, equipment, and high-value assets. With predefined workflows, credit controls, and data integrations, you can deploy with speed, accuracy, and compliance from day one.

Prebuilt application flows

Tailored for business customers, agents, or intermediaries, with journeys you can customise to fit your asset-based lending model.

Proven risk frameworks

Ready-made scoring models, approval logic, and credit rules that are easy to adapt to your policies.

Integrated data connections

Business verification, asset data, and financial records you can access instantly through pre-integrated connectors.

Why choose Zoot?

85% straight-through processing from day one

28% more vulnerable customers accurately identified

25% Faster Decision

Ready to Transform Your Asset Financing?

Let’s talk about what asset and equipment financing transformation looks like for your business.